X3 Leasing - Trusted Financial Institution in Lagos

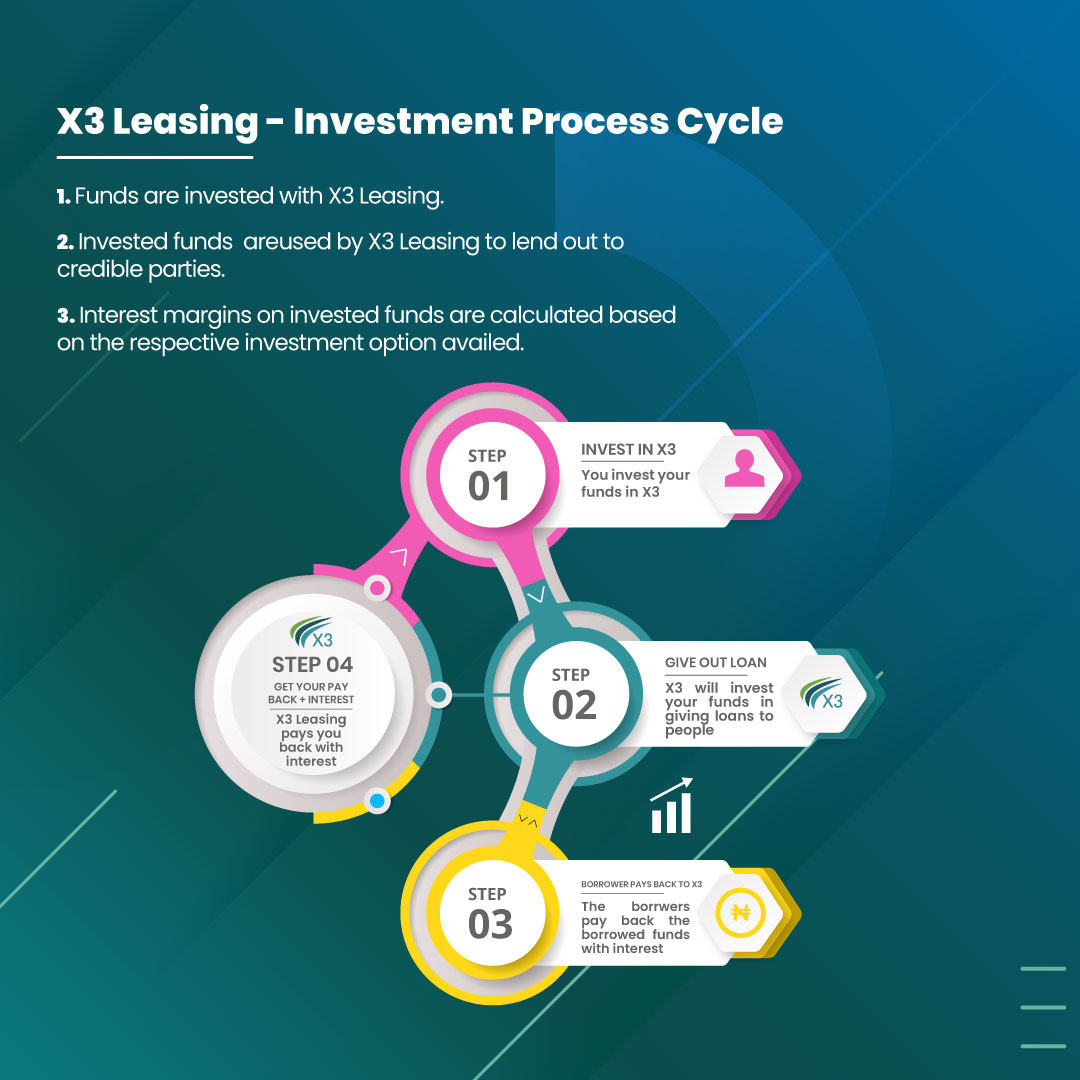

X3 Leasing Limited is a consumer finance firm offering diversified loan and investment solutions for businesses, organizations, and individuals. Our primary objective is to make the process of borrowing money convenient, secure, and transparent. From small business loans to salary advances, we provide easy loans in Nigeria with benefits of instant disbursements, minimal interest rates, and round-the-clock customer support.

Under the care of X3 Leasing, MyX3 and Loan35 are two loan platforms in Nigeria also providing financial assistance to match different needs seamlessly.